Bad Debts Are Estimated To Be 1.5 Of Credit Sales 36+ Pages Summary [1.5mb] - Latest Update

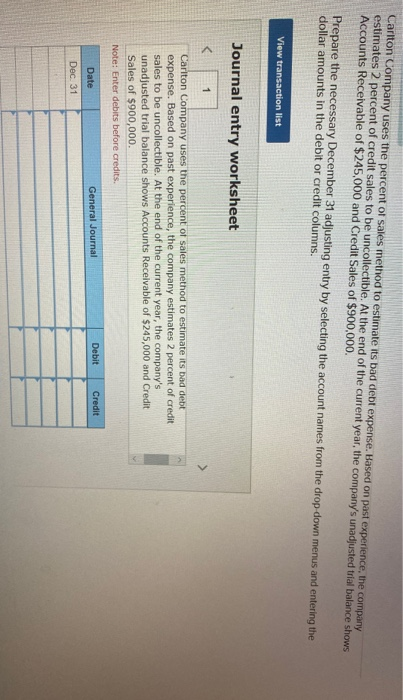

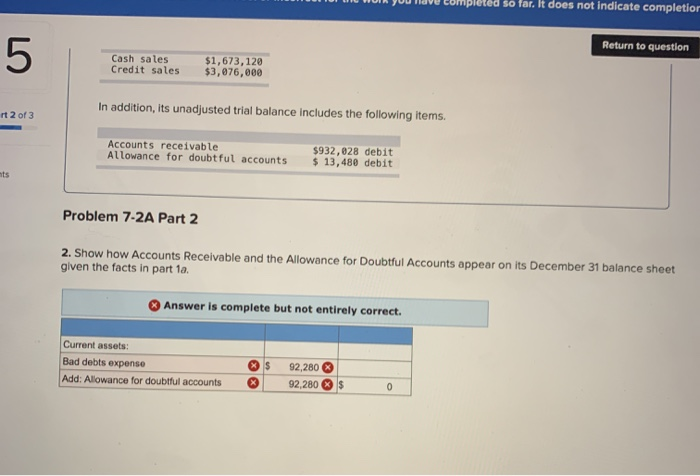

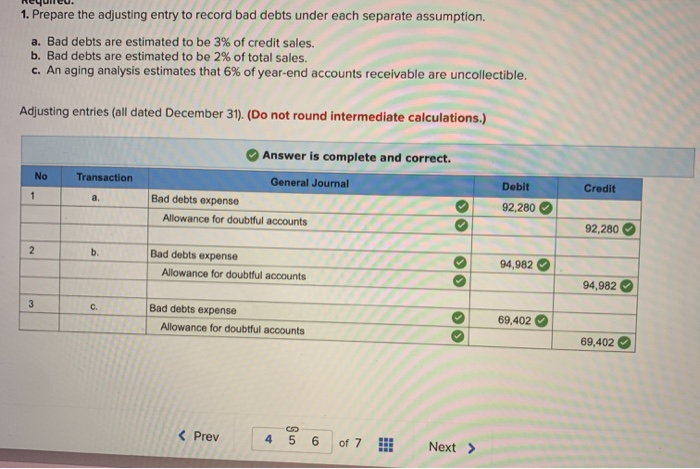

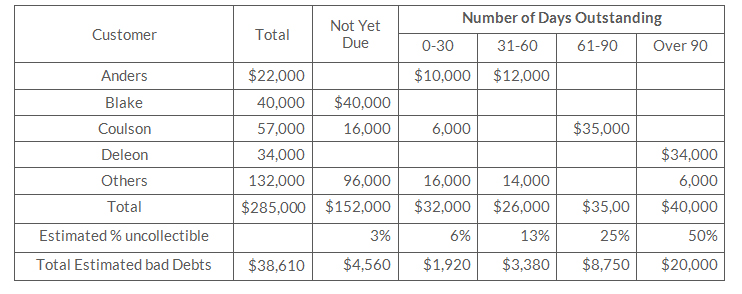

95+ pages bad debts are estimated to be 1.5 of credit sales 3.4mb. Prepare the necessary adjusting entries to record bad debts expenses assuming this companys bad debts are estimated to equal. An aging analysis estimates that. Prepare the adjusting entry to record bad debts under each separate assumption. Check also: sales and learn more manual guide in bad debts are estimated to be 1.5 of credit sales The percentage of credit sales method is explained as follows.

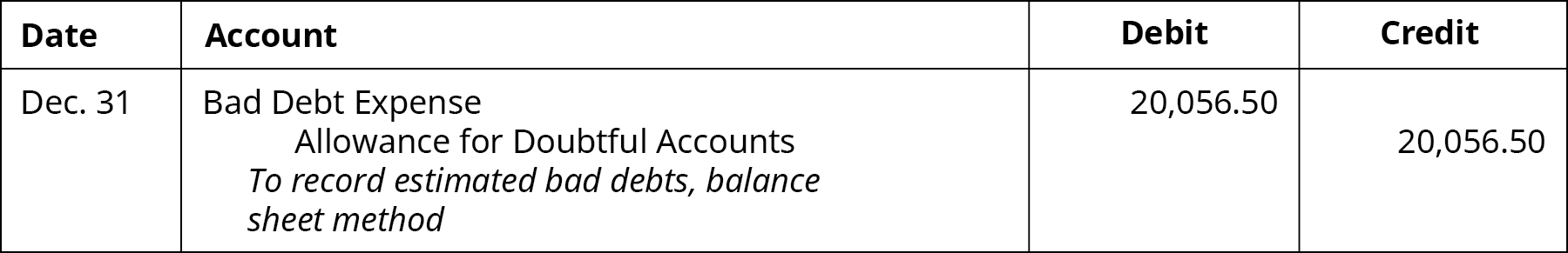

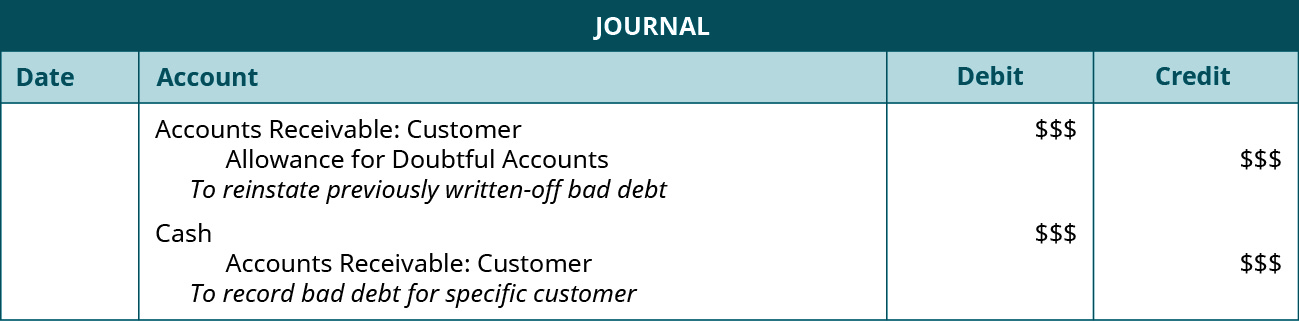

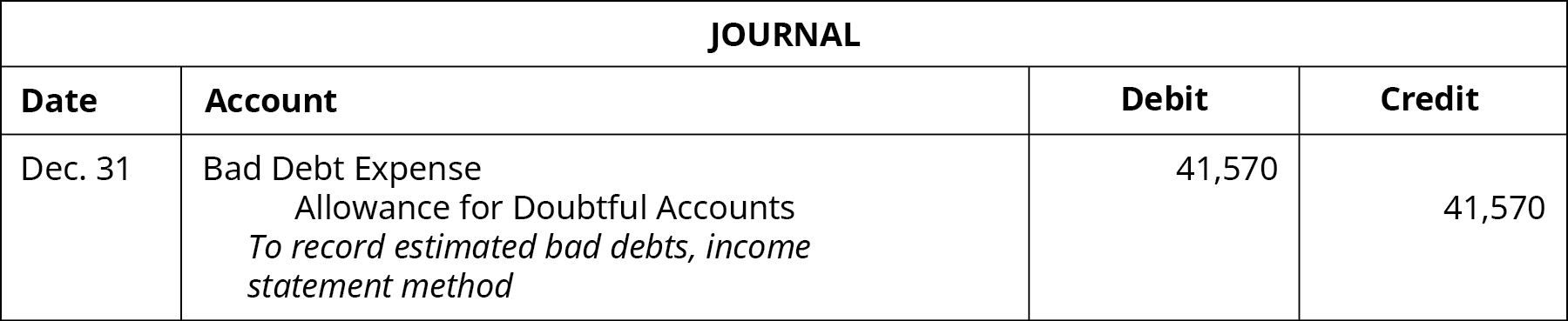

A company uses the allowance method for estimating bad debts and has decided that 15 of total sales will be uncollectible. The entry involves a debit to bad debts expense account and a credit.

Estimating Bad Debts Allowance Method

| Title: Estimating Bad Debts Allowance Method |

| Format: eBook |

| Number of Pages: 186 pages Bad Debts Are Estimated To Be 1.5 Of Credit Sales |

| Publication Date: September 2021 |

| File Size: 1.2mb |

| Read Estimating Bad Debts Allowance Method |

|

Bad debts are estimated to be 15 of credit sales.

View the full answer. Bad debts are estimated to be 1 of total sales. A Debit Cash of 300 and Accounts Receivable for 300 B Debit Cash of 300 and Credit Sales for 300. Bad debts 15 of credit sales 5682000 15 85230 Journal entry Bad debt expense 85230 Allowance for uncollectible 85230 b. Bad Debts Expense Estimated Credit Sales After the estimation of bad debts an adjusting entry is passed to recognize the bad debts expense. Bad debts are estimated to be 1 of total sales.

Required Information Uncollectibles Are Estimated Chegg

| Title: Required Information Uncollectibles Are Estimated Chegg |

| Format: PDF |

| Number of Pages: 330 pages Bad Debts Are Estimated To Be 1.5 Of Credit Sales |

| Publication Date: December 2017 |

| File Size: 2.8mb |

| Read Required Information Uncollectibles Are Estimated Chegg |

|

1 Prepare The Adjusting Entry To Record Bad Debts Chegg

| Title: 1 Prepare The Adjusting Entry To Record Bad Debts Chegg |

| Format: eBook |

| Number of Pages: 263 pages Bad Debts Are Estimated To Be 1.5 Of Credit Sales |

| Publication Date: May 2017 |

| File Size: 1.35mb |

| Read 1 Prepare The Adjusting Entry To Record Bad Debts Chegg |

|

Estimating Bad Debts Financial Accounting

| Title: Estimating Bad Debts Financial Accounting |

| Format: PDF |

| Number of Pages: 327 pages Bad Debts Are Estimated To Be 1.5 Of Credit Sales |

| Publication Date: October 2021 |

| File Size: 810kb |

| Read Estimating Bad Debts Financial Accounting |

|

1 Prepare The Adjusting Entry To Record Bad Debts Chegg

| Title: 1 Prepare The Adjusting Entry To Record Bad Debts Chegg |

| Format: eBook |

| Number of Pages: 269 pages Bad Debts Are Estimated To Be 1.5 Of Credit Sales |

| Publication Date: July 2019 |

| File Size: 2.1mb |

| Read 1 Prepare The Adjusting Entry To Record Bad Debts Chegg |

|

3 4 Bad Debt Expense And The Allowance For Doubtful Accounts Financial And Managerial Accounting

| Title: 3 4 Bad Debt Expense And The Allowance For Doubtful Accounts Financial And Managerial Accounting |

| Format: ePub Book |

| Number of Pages: 307 pages Bad Debts Are Estimated To Be 1.5 Of Credit Sales |

| Publication Date: April 2017 |

| File Size: 1.6mb |

| Read 3 4 Bad Debt Expense And The Allowance For Doubtful Accounts Financial And Managerial Accounting |

|

3 4 Bad Debt Expense And The Allowance For Doubtful Accounts Financial And Managerial Accounting

| Title: 3 4 Bad Debt Expense And The Allowance For Doubtful Accounts Financial And Managerial Accounting |

| Format: PDF |

| Number of Pages: 235 pages Bad Debts Are Estimated To Be 1.5 Of Credit Sales |

| Publication Date: August 2018 |

| File Size: 2.8mb |

| Read 3 4 Bad Debt Expense And The Allowance For Doubtful Accounts Financial And Managerial Accounting |

|

Accounting For Receivables

| Title: Accounting For Receivables |

| Format: eBook |

| Number of Pages: 231 pages Bad Debts Are Estimated To Be 1.5 Of Credit Sales |

| Publication Date: October 2018 |

| File Size: 1.35mb |

| Read Accounting For Receivables |

|

3 4 Bad Debt Expense And The Allowance For Doubtful Accounts Financial And Managerial Accounting

| Title: 3 4 Bad Debt Expense And The Allowance For Doubtful Accounts Financial And Managerial Accounting |

| Format: PDF |

| Number of Pages: 128 pages Bad Debts Are Estimated To Be 1.5 Of Credit Sales |

| Publication Date: August 2020 |

| File Size: 1.7mb |

| Read 3 4 Bad Debt Expense And The Allowance For Doubtful Accounts Financial And Managerial Accounting |

|

Estimating Bad Debts Allowance Method

| Title: Estimating Bad Debts Allowance Method |

| Format: ePub Book |

| Number of Pages: 137 pages Bad Debts Are Estimated To Be 1.5 Of Credit Sales |

| Publication Date: June 2018 |

| File Size: 1.1mb |

| Read Estimating Bad Debts Allowance Method |

|

Estimating Bad Debts Allowance Method

| Title: Estimating Bad Debts Allowance Method |

| Format: ePub Book |

| Number of Pages: 218 pages Bad Debts Are Estimated To Be 1.5 Of Credit Sales |

| Publication Date: September 2019 |

| File Size: 800kb |

| Read Estimating Bad Debts Allowance Method |

|

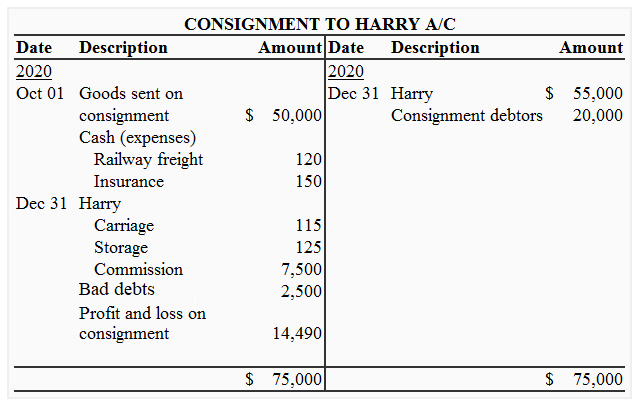

Del Credere Mission And Credit Sales Definition Explanation Examples Accounting For Management

| Title: Del Credere Mission And Credit Sales Definition Explanation Examples Accounting For Management |

| Format: ePub Book |

| Number of Pages: 219 pages Bad Debts Are Estimated To Be 1.5 Of Credit Sales |

| Publication Date: April 2017 |

| File Size: 810kb |

| Read Del Credere Mission And Credit Sales Definition Explanation Examples Accounting For Management |

|

Estimating your bad debts usually involves some form of the percentage of bad debt formula which is just your past bad debts divided by your past credit sales. Adjusting entries all dated December 31. Bad debts are estimated to be 15 of credit sales.

Here is all you need to read about bad debts are estimated to be 1.5 of credit sales 1Prepare the adjusting entry for this company to recognize bad debts under each of the following independent assumptions. Bad debts are estimated to be 1 of total sales. Prepare the adjusting entry for this company to recognize bad debts under each of the following independent assumptions. 3 4 bad debt expense and the allowance for doubtful accounts financial and managerial accounting estimating bad debts financial accounting 3 4 bad debt expense and the allowance for doubtful accounts financial and managerial accounting accounting for receivables estimating bad debts allowance method required information uncollectibles are estimated chegg Bad debts are estimated to be 15 of credit sales.

Tidak ada komentar:

Posting Komentar